At Solar Energy Solutions, we’re always up for sharing bright ideas. There’s currently a lot going on on the solar energy front. Here, you can learn more about everything from legislative issues and technological advancements to important factors you need to consider before going solar and the environmental benefits to making that change to clean energy.

5695 Solar Tax Credit Form Instructions for 2022

2022 Tax Season The 2022 tax season is here! So, if you installed a solar system in 2022, it’s time to get your 30% tax credit. Below is a link …

Why Go Solar in 2023

2023 is gearing up to be one of the best years to upgrade your Illinois, Indiana, Kentucky, or Ohio home or business with a solar energy system! For years, solar …

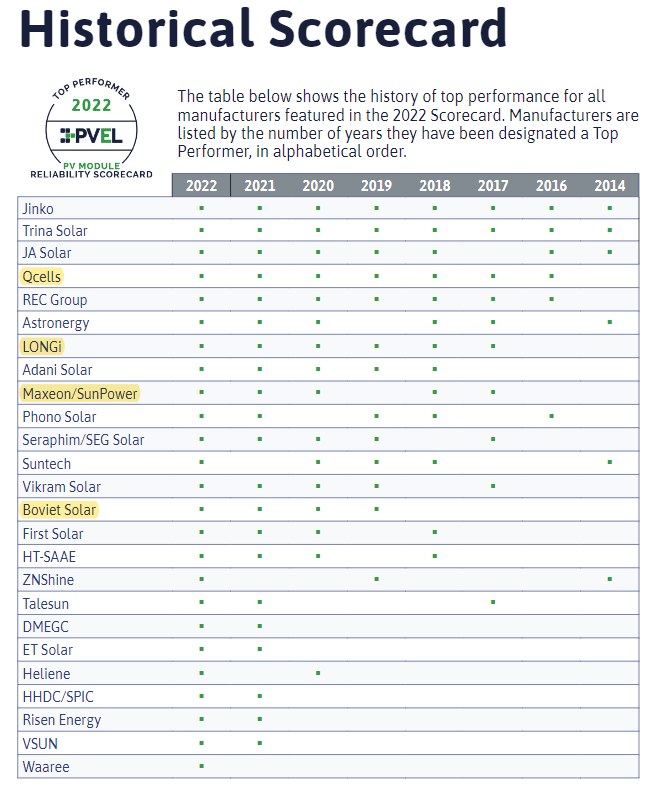

PVEL Top Solar Panel Ratings for 2022

PVEL is the leading independent lab for the global downstream PV industry. They put solar panels through rigorous testing to find out which are the most durable, long lasting panels. We are committed to …

How Do Solar Panels Lower Your Electricity Bill?

If there are two things most homeowners hear about solar panel installation, it’s that solar panels are good for the environment and that solar panels will save you money. But …

Recommend Us and Join Our Customer Referral Bonus Program

Our Thank-you to you: At Solar Energy Solutions we strive to install the highest quality solar energy systems for our customers. We design systems to meet the unique goals and …

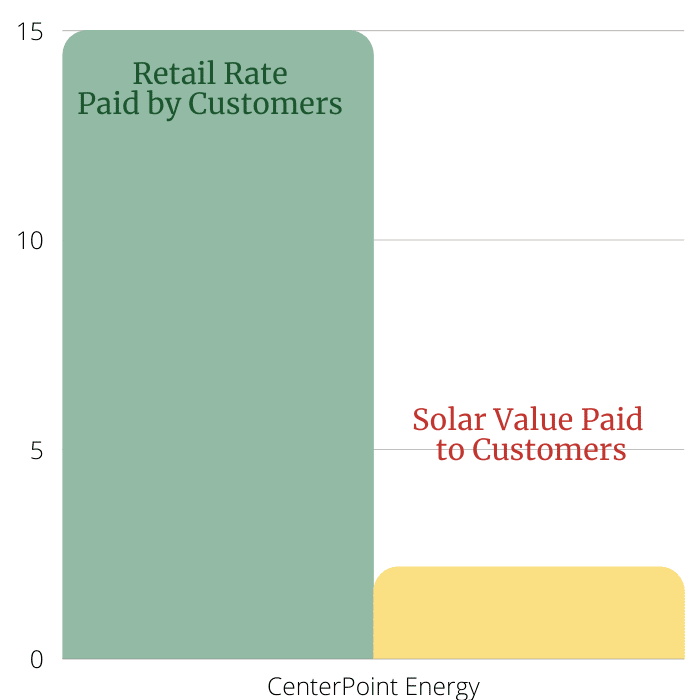

Changes to Indiana Net Metering Policy

Indiana’s Changes to Net Metering Are As Bad As They Get Big changes are here to net metering for Indiana. These changes all stem from a law passed in 2017, SEA …

New Information on the USDA REAP Grants for Farmers Savings in 2023

Solar Energy Solutions has years of expertise in connecting farmers with experienced grant writers to secure USDA REAP grants and loan funding for solar projects. This funding is in addition to …

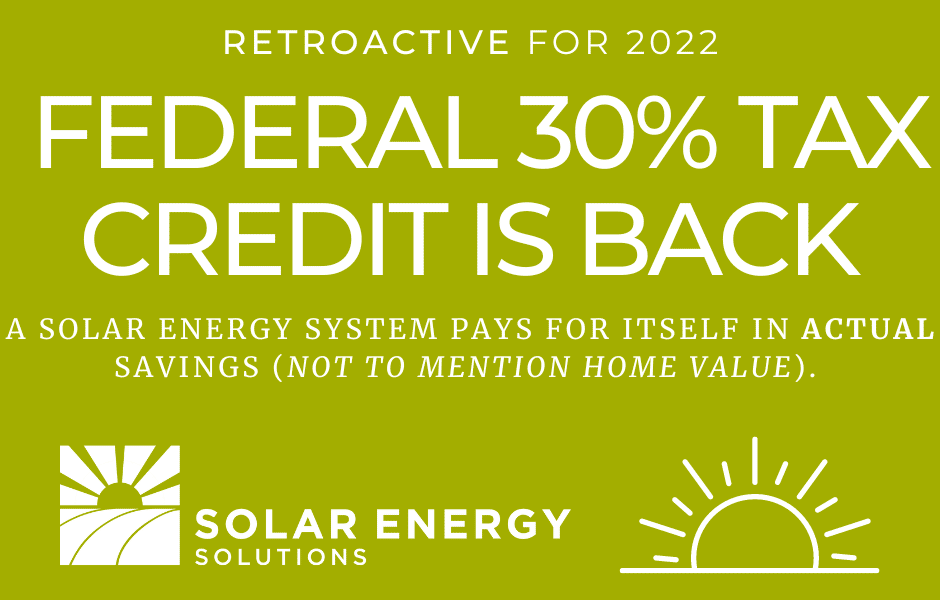

Solar Tax Credit: Get 30% of your Install Price Back With the IRA Plus More

With the Investment Reduction Act, solar is now more affordable for 2022 and beyond with the return of the 30% solar tax credit. The solar tax credit had stepped down to 26% for 2022, and was set to go down again to 22%, but now it will be 30% 2022 and for 10 years before it’s set to step down again.

Inflation Reduction Act For Commercial Solar

The Inflation Reduction Act will help commercial entities lower costs for years to come. Commercial solar is one of the safest investments you can make. It will literally pay for itself in utility savings and tax benefits. That means lower operating costs which allow your company to compete from a better financial position.

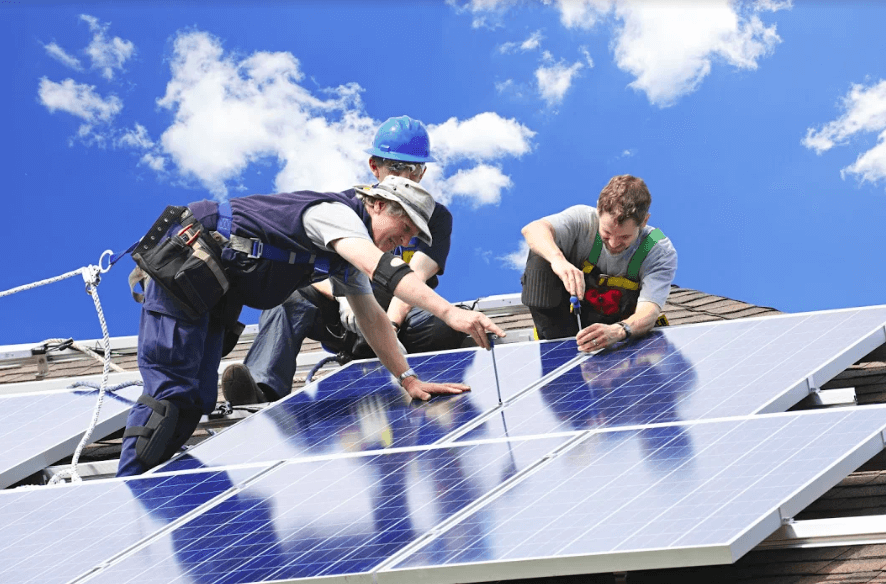

Solar Installer Qualifications

It’s hard to know what to look for in an installer. Solar is a relatively new thing in the grand scheme of things. Other bigger purchases in your life, like …