Commercial Solar Installation

Commercial solar installation is a smart investment for your business.

Don’t miss out on commercial solar benefits. Schedule a consultation today. 877-312-7456

Commercial solar panels improve your bottom line and lock in your electricity costs, protecting you from rising energy costs. They have an excellent return on investment, and they qualify for valuable tax benefits.

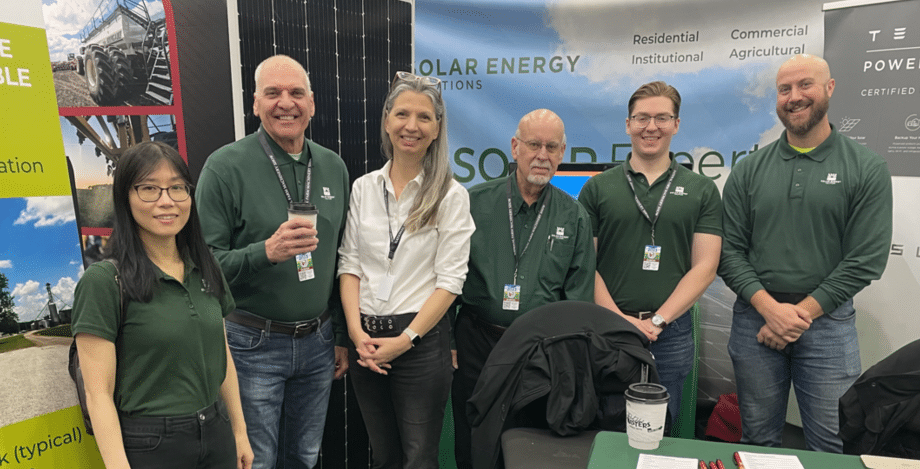

Solar Energy Solutions is the leading commercial solar installer for businesses and non-profit organizations in Illinois, Indiana, Kentucky, Ohio, and Virginia. We are a local, family-owned business with over 17 years of experience. With our team, you get the efficiency and expertise of a large solar company and the personalized service you’ll only find with a family business.

Why Choose Us?

- 17+ years of experience

- 2,500+ solar installations

- Fully in-house team

- 24/7 system monitoring

Benefits of Commercial Solar Panels

Businesses have a lot to gain by going solar.

- Save on operating costs – Commercial solar panels can reduce or even eliminate your electricity costs and utility demand charges, saving your organization a significant amount of money every month.

- Meet environmental goals – A commercial solar installation is likely all you need to meet your corporate environmental goals or CO2 reduction targets.

- Reduce your carbon footprint – Solar panels generate renewable energy that’s good for the planet and will cut your organization’s carbon emissions.

- Market your environmental appeal – Your investment in clean energy can be used as a marketing tactic to increase your customer base and bring on new talent.

- Get reliable backup power – Solar panels with battery backup like the Tesla Powerwall 3 or Tesla Powerpack can keep your essentials running during a power outage to prevent downtime and waste.

Commercial Solar Incentives

Commercial solar panel installations qualify for tax incentives that make the payback period quicker and more profitable for your company.

Investment Tax Credit

The solar investment tax credit reduces your business’s federal tax liability by 30% of your solar installation costs. The ITC provides an upfront tax credit that your business will benefit from immediately. A direct payment option is available for tax-exempt organizations.

Production Tax Credit

The production tax credit (PTC) is based on the amount of power your solar panels produce during their first 10 years in operation. However, businesses cannot claim the ITC and the PTC—they must choose one or the other. The PTC is ideal for large commercial solar panels with exceptionally high outputs.

MACRS Accelerated Depreciation

Commercial solar installations are eligible for a 5-year cost recovery period through the Modified Accelerated Cost Recovery System (MACRS).

REAP Grants

Agricultural producers and rural small businesses are eligible for REAP grant funding worth up to 50% of their commercial solar installation costs. REAP grants can be combined with the solar ITC and MACRS depreciation, saving you over 80% on your solar installation!

Is solar right for your business? Call 877-312-7456 or contact us to talk to an expert.

Commercial case studies

Check out these shining examples of our solar expertise at work.